20th January 2026

Claire House Children's Hospice

Read More

15th January 2026

Golf-Themed Cigarette and Trade Cards Take Centre Stage at Warwick & Warwick Auction

Read More

12th January 2026

1919 Newfoundland Hawker

Read More

1st January 2026

Warwick & Warwick – 2025 Year in Review

Read More

22nd December 2025

2026 Auction dates

Read More

17th December 2025

Christmas Opening Hours

Read More

3rd December 2025

Stunning Ancient Coins collection to be offered in our 10th December 2025 auction!

Read More

27th November 2025

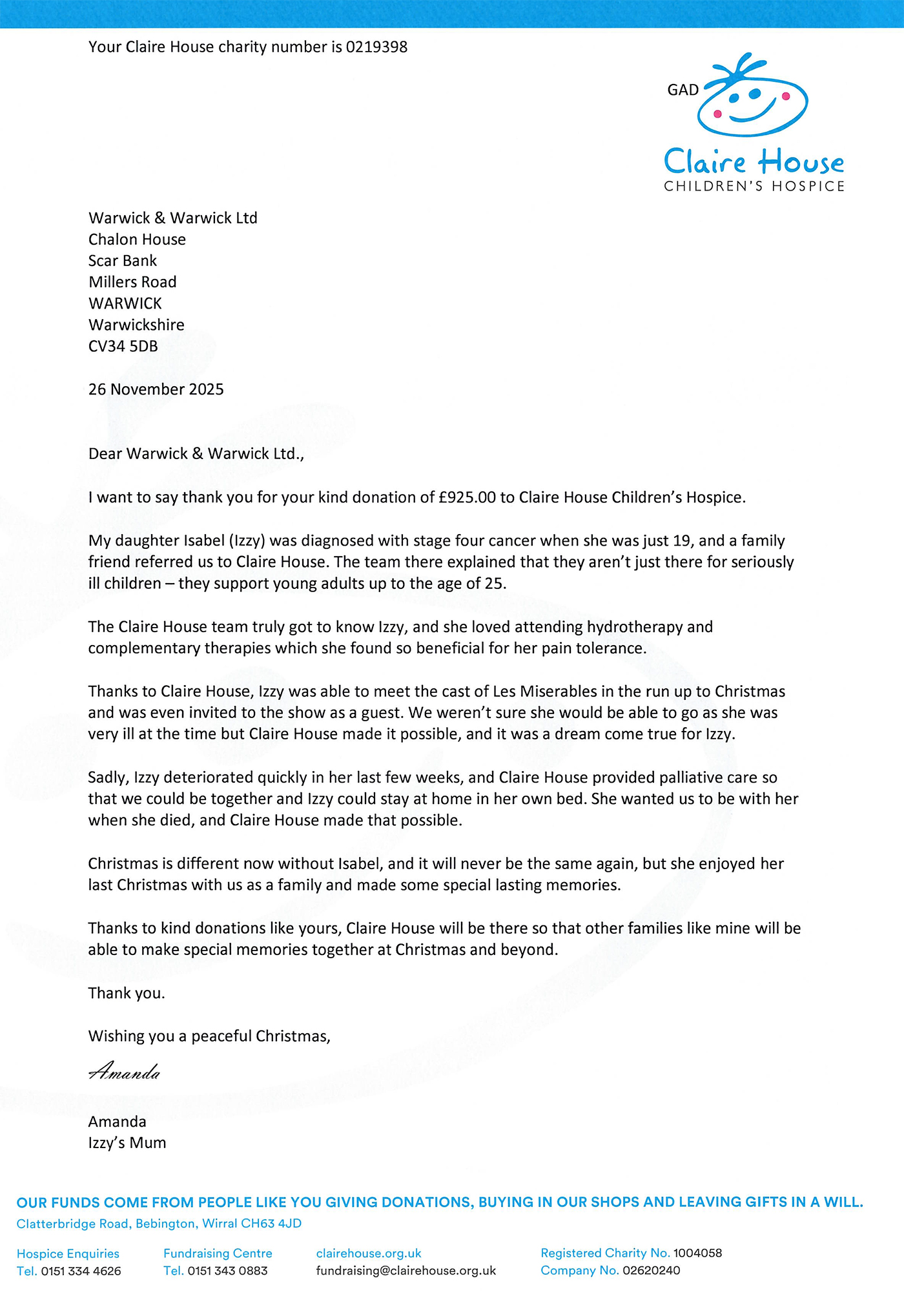

Claire House Children's Hospice

Read More

20th November 2025

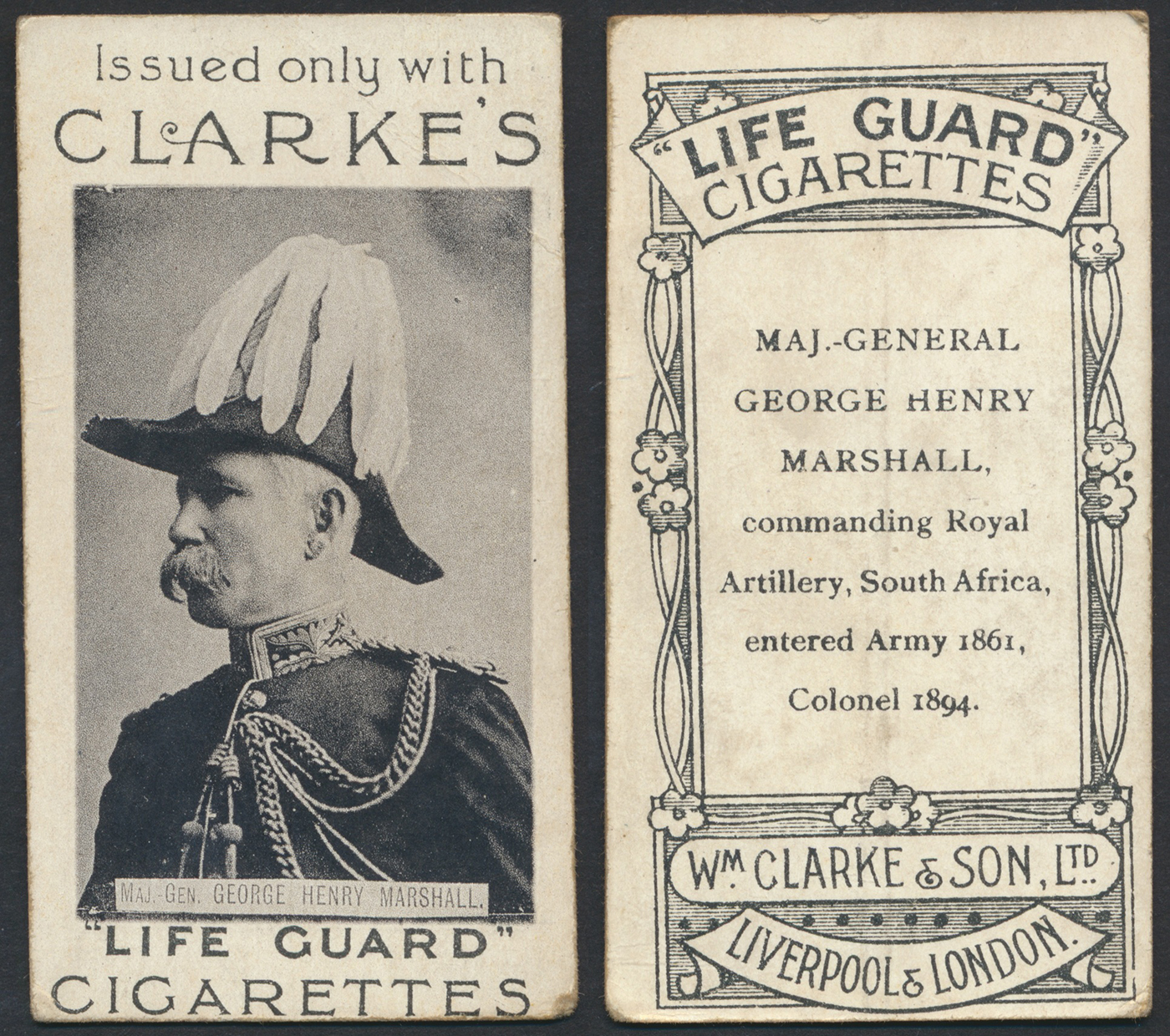

All Clap for Clarke!!

Read More

13th November 2025

Claire House Children's Hospice

Read More

31st October 2025

Claire House Children's Hospice

Read More

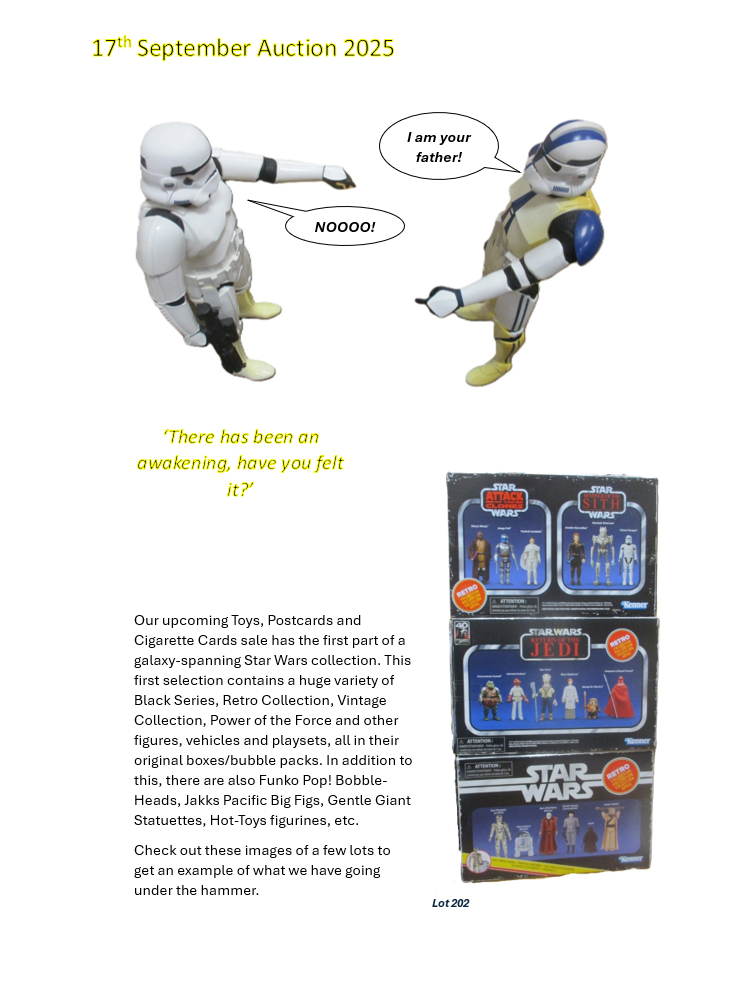

17th September 2025

‘There has been an awakening, have you felt it?’

Read More

1st September 2025

Saturday 13th September open hours.

Read More

10th July 2025

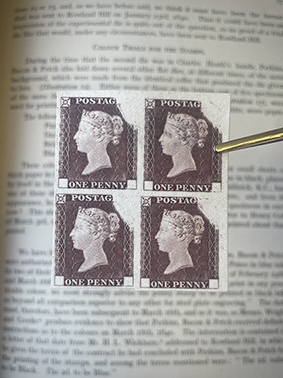

The ‘Rainbow’ Colour Trials

Read More

16th May 2025

Temporary Power Disruption

Read More

14th March 2025

Donation to the Samaritans

Read More

20th February 2025

Open Day Saturday 15th March 2025

Read More

- Company No. 01555455

- VAT No. GB185018801

- Warwick & Warwick Ltd 2026